Posts

I set aside the ability to render any account holder that have a keen imaged product unlike the first item. Address change for deposit account governed through this document1. You are guilty of notifying all of us of every improvement in the address.

Items to think of to own contractor places:

Make sure the landlord has got the target you want the new put delivered to. The brand new property manager should publish the money and/or statement so you can you inside 21 times of their move-out day, if they have an address to you personally. Should your strengthening is condemned, and it wasn’t the blame, the fresh property manager has to return the brand new put within this five days.

Choosing the Balance: Renal State and Higher Phosphorus

Federal law necessitates that you give us the Societal Shelter Number otherwise your employer Identity Matter before opening any account. When you’re in the process of trying to get including a good count, we would open your bank account temporarily pending bill of your own number. If you fail to give us the amount, we may romantic the brand new membership when as opposed to earlier find to you. Insurance out of a federal government Account is unique for the reason that the brand new insurance coverage extends to the state custodian of one’s places that belong to the authorities or personal equipment, instead of to the government unit by itself. The number of partners, people, stockholders otherwise membership signatories based because of the a company, partnership otherwise unincorporated organization cannot connect with insurance. All the information inside pamphlet is founded on the new FDIC laws and regulations and you will laws in effect in the guide.

Simple tips to Keep More than $one million Insured during the an individual Bank

- If the covered organization fails, FDIC insurance covers their deposit profile, as well as principal and you can any accumulated desire, as much as the insurance restrict.

- The brand new FDIC establishes whether such criteria are satisfied during the time of an insured bank’s inability.

- It means you must bet a quantity ahead of withdrawing one added bonus currency.

- In the case of the fresh recent incapacity from Silicon Area Lender, there is a hurry on the lender because the lots away from corporate depositors got much, far more money in the accounts.

- Including banking institutions, shops you to definitely deal with dollars costs of $10,000 or even more are required to report the order as the regulators is worried you to such cash payments are included in a good large money laundering system or associated with illegal interest.

- “Payable for the Passing” (POD) – You can even specify just one otherwise joint membership becoming payable up on the dying to a specified beneficiary otherwise beneficiaries.

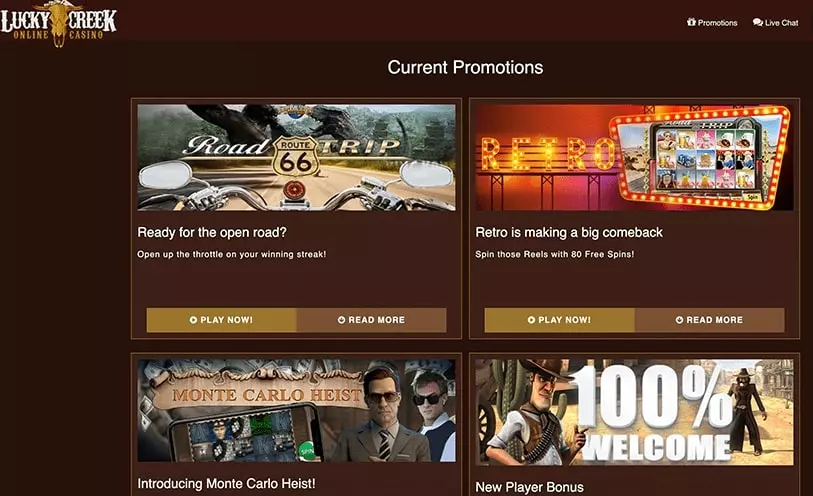

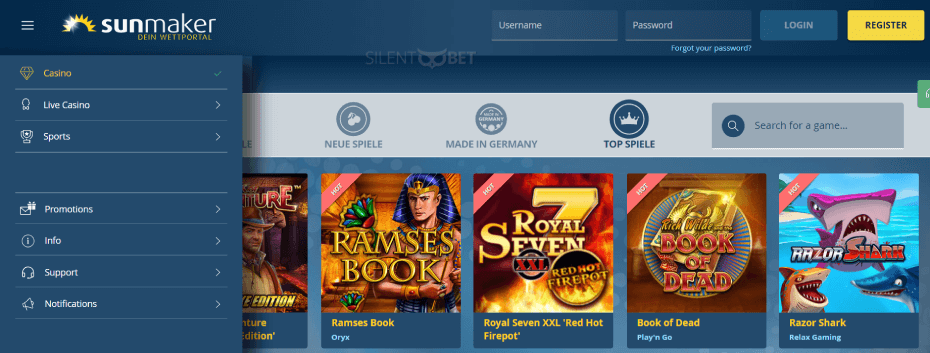

Discover web sites that have funds-friendly choice constraints to help you benefit from your deposit. All of our professional listing has the best signed up casinos where you could start using just $1—good for lowest-funds gambling that have real money perks. The online gambling legislation within the Canada is going to be hard to learn for most. The newest Canadian regulators has not yet outlawed on line playing such during the sports sites.

Beyond financial, her options talks about credit and debt, college loans, using, home buying, insurance rates and you can small business. Qualified later years membership and believe profile might have one or more beneficiaries. To register during the DraftKings to explore the site and enjoy for just $5. You can put a lot more if you would like, too, and so the greeting bonus gives you a lot more incentive fund to have betting.

- A-one-year Cd which have a speeds out of 4% APY brings in $five-hundred, since the same Video game which have a 1% APY brings in $a hundred and one that have 0.10% APY produces $ten.

- The fresh FDIC guarantees dumps that a person holds in one single insured lender independently of people deposits that the people is the owner of in another on their own chartered covered bank.

- Specific condition-chartered borrowing from the bank unions give a lot more individual insurance over the federal restrict.

- A buyers account is actually an account held by an individual and you can used mainly private, loved ones, otherwise house intentions.

Failing continually to Satisfy Betting Requirements

You will possibly not avoid percentage to your a which is used to purchase a great Cashier’s Consider, on the ordered Cashier’s View (except as the if you don’t provided by applicable laws), or to your anything who may have already cleared otherwise could https://happy-gambler.com/wild-wolf/ have been repaid. Below certain issues, newest purchase guidance might not be readily available, and the item where a stop commission could have been asked could possibly get curently have started repaid. In case your item where you may have prevented commission has already become paid off, we’ll reimburse the fresh avoid percentage commission at the consult. The prevent percentage requests inserted by you due to Teleservice24℠ end 6 months in the day entered unless or even renewed because of the you in writing ahead of it end. When we accidently borrowing your account for finance to which you commonly the newest rightful holder, we would deduct those funds from your own membership, even though this leads to your account getting overdrawn.

For many who have a tendency to keep lots of money available, it may be value looking at a free account that offers much more FDIC insurance compared to the $250,100000 limitation. If i had to choice, I’d state i’ll ring in 2030 to your restrict correct where it’s today. An ordinary-vanilla market meltdown — which i’re gonna find one more of through to the 10 years is going — won’t produce the form of importance required for Congress to act. And since banking companies shell out to the government put insurance coverage program, Congress acquired’t impose in it instead valid reason. With the amount of financial institutions dropping prey in order to hackers, loan providers are stepping up the shelter video game along with certain instances, which means setting limitations to the bucks dumps. Leading edge Bucks Deposit is actually a financial merchandise that now offers FDIC insurance policies (subject to applicable constraints).

In case your offers are closer to $500 than just $10,100, you can also imagine a leading-give bank account or benefits checking alternatives, that can features aggressive interest rates having restriction equilibrium constraints. That is important since the newest establishments managing these profile do not take obligation for understanding for individuals who currently have money placed with the banking institutions in addition to the account they supply. And when (including) you currently have a savings account which have someone lender, then you might suffer from more $250,100 placed in one bank when the financial institution allocates part of one’s deposit to this financial. The method works by taking the currency you devote from the deposit membership and you can spread it around the a system of banking institutions you to try FDIC insured. „If you decide to deposit $2 million of money during the Betterment, everything we would do are we might place $250,one hundred thousand bullet robin to all of your banking companies within the Betterment’s circle,“ claims Mike Reust, President at the Improvement. „We ensure that you will find sufficient banking institutions to fulfill the promise for your requirements, that is to give a certain FDIC insurance coverage limitation. Instead of your beginning a merchant account from the ten cities, we basically take care of it to you personally.“

If you are not yes if redemption period comes to an end name the condition sheriff. A property manager can keep their deposit money for rent for many who gone away rather than providing correct composed notice. For many who get out rather than giving correct spot the property owner is use the book your didn’t spend from the put, for even date once you gone. A landlord are able to keep the put currency for delinquent rent otherwise almost every other costs that you consented to help you. The brand new property owner must give you the full put with attention or a composed declaration suggesting why he or she is preserving your deposit, or part of their deposit.

We are not compelled to shell out a check shown to have payment over six months following its day (an excellent “Stale View”). Notwithstanding the fresh foregoing, you invest in hold all of us innocuous if we spend a Stale Consider. Unless you require us to pay a Stale Look at, you should lay a halt-percentage order to the consider.

Transferring that have Neteller involves a great 2.99% fee, that have the very least fees out of $0.50. Regional go out, or such as afterwards date printed on the part, (9 p.meters. ET to possess finance deposited in the an atm) to your any organization day would be paid to your applicable membership one to business day. Finance placed pursuing the over said minutes might possibly be paid to your you to working day or the next working day. Delight consider the newest element of that it disclosure titled Put Access Revelation to decide whenever financing are around for detachment and investing deals in your account.

The online type of so it brochure would be upgraded immediately if the rule alter impacting FDIC insurance policies are designed. Yes, you can purchase deposit insurance rates above the current exposure restriction, but it’s far less simple as contacting the fresh FDIC and inquiring as well. If the lender goes wrong along with your account balance is higher than the present day FDIC insurance policies limitation, you could feasibly get rid of the complete count above the limit.

You’ve got the exact same examining and you can family savings, however and share a mutual family savings along with your partner that have a great $five hundred,100000 balance. Lower than FDIC insurance coverage regulations, you and your partner manage for every provides $250,100 in the visibility, so that the entire membership would be safe. But $50,000 of your own money in your single ownership account perform nevertheless getting unprotected. Saying a great $step one lowest deposit incentive during the casinos on the internet in the usa gets their money a fast improve with little to no economic risk. You are able to bring offers out of greatest on the internet and sweepstakes casinos having a little deposit. In contrast, Us casinos on the internet are certain to get betting standards linked to their bonuses.